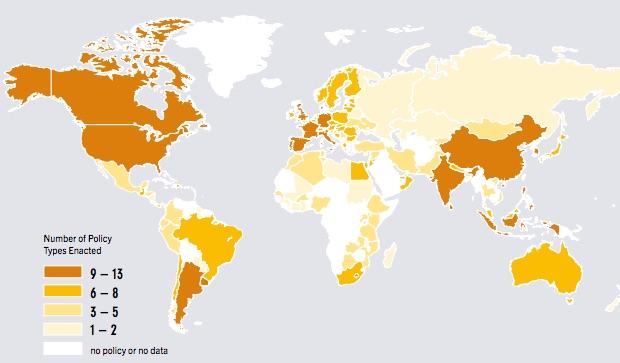

Feed-in tariffs, tax incentives, rebates, net metering, voluntary goals, portfolio standards and market-based solutions…what works, and what’s next?

In nearly every region of the globe, electricity generation from solar PV (photovoltaic) is experiencing exponential growth. Between 1995 and 2016, global PV generating capacity grew from 600 megawatts (MW) to 256,000 megawatts. This incredible rate of growth did not occur in a vacuum, however. Technological advancements, market forces and government policies combined to stimulate rapid deployment. We can look at current trends, compare the national policies of some of the world’s solar leaders and draw some conclusions about what has worked and what has not.

Germany, Japan, and Italy Lead the Way

The biggest generators of solar are currently China, Japan, Germany, United States and Italy. While we will be looking primarily at the solar incentive policies of these top five nations, we will also look at some smaller countries that are leading in terms of per capita generation of solar. When measuring solar on a per capita basis, the U.S. and China drop out of the top five, with Belgium and Greece making strong top five showings. Germany, Japan and Italy lead in both installed and per capita solar installations.

Germany: A Mature Market Sees Slower Growth

Germany’s commitment to renewable energy development has been nothing short of phenomenal. On April 30th of 2017, Germany hit a one-day record, with 85% of all electricity used in Germany came from renewable sources including solar, wind and hydro. How did Germany manage this impressive feat? The key to the success of solar in Germany has been through the use of a policy mechanism commonly known as a “Feed-In Tariff” or FIT. According to a report on German solar policies by the Solar Energy Industries Association (SEIA):

“FITs guarantee a fixed compensation for electricity produced from solar PV facilities for a period of 20 years. The program requires that transmission system operators (TSOs) purchase all the power produced from these PV systems. TSOs in turn sell the power on wholesale markets and are made whole through a renewables levy (“EEG-Umlage” in German), which is collected from most customers. Heavy electricity users in trade-sensitive areas are (partially) exempt from this renewables levy. Under the program, solar PV installations have increased dramatically, reaching a total installed capacity in excess of 35 GW by year-end 2013.”

Despite the Success of FITs, it appears that they have reached the end of their usefulness for Germany. Because of the amount of renewable capacity available, Germany is producing excess electricity because the older coal and nuclear plants (that provide power in times of lower renewable output) cannot be turned on and off quickly. They can’t sell the excess renewable generation outside of Germany, due to current laws and agreements among European Union partners. The German parliament is looking for solutions to this problem and is moving away from FITs to a new auction system by which developers will bid on renewable projects based on capacity limits set by the government. This more market-based approach may become more common as global markets for solar reach maturity.

China: An Explosion of Solar

It is not unusual to see news stories about the horrible air pollution problems in China. News photos show Beijing residents wearing protective masks as they walk through clouds of smog. China has been completing construction of a new coal-fired power plant every week in an attempt to power their epic growth in manufacturing. Ironically, one of the things being manufactured in China is cheap solar panels.

In January 2017, China began canceling orders for new coal plants. Acknowledging the astronomical environmental problems caused by the new plants, China is turning more to installing new renewable generation, although they are still a long way from mitigating the damage done by new, dirty coal plants.

Chinese energy policy is set by its National Energy Agency (NEA). China also uses a form of feed-in tariff to encourage the development of solar energy. The NEA recently announced that in the period from March 2016 to March 2017, solar power generation rose to 21.4 billion kilowatt-hours. China added 7.21 gigawatts of solar power during the period, boosting its total installed capacity to almost 85 gigawatts. This amounts to an 80% increase in renewable generation and unfortunately, much of power is being wasted because China simply does not have the transmission assets to deliver the power to market. This is leading China to cut FITs as much as 52%, intentionally putting the brakes on solar growth.

More Feed-In Tariff Successes and Challenges

Japan, Italy, Belgium, Greece and many other nations around the globe have all adopted FITs of one sort or another. In most cases they have proven successful in the short-term, providing the price stability to assure a reasonable return on investment and stimulating rapid expansion in the solar market. Most countries have set feed-in tariffs to sunset in either 10 or 20 years. However, many countries are reducing rates for FITs or implementing size caps because of the steep drop-off in the price of installed solar as China has flooded the global market with cheap solar panels. Japan has dropped their FIT rate from 28 to 21 Yen per kilowatt hour (kWh) for residential systems under 10kW.

U.S. Solar Growth Relies on Federal and State Policies

Many American renewable energy advocates have called for the United States to adopt European-style feed-in tariffs. In reality, The U.S. passed the first FIT in 1978, under president Jimmy Carter. It was not called a feed-in tariff, but the Public Utility Regulatory Policies Act (PURPA) did function in much the same way as a contemporary FIT. Different states have interpreted PURPA in a number of ways, and PURPA has been open to a wide range of legal interpretation over the years.

The most significant federal incentive for solar in the U.S. has been the solar Investment Tax Credit (ITC) which was passed as part of the 2005 energy bill. The ITC is a 30 percent tax credit for solar systems on residential and commercial properties.

SEIA and other advocates successfully lobbied for a multi-year extension of the credit in 2015 which should continue to spur solar growth until it sunsets in 2021. According to SEIA:

“On the state level, net-metering policies have been critical to the success solar has achieved in those states. Net metering is a mechanism by which solar producers can feed their extra electricity onto the grid during sunny times, and buy it back at retail rates when they need it. In addition, some states have instituted state tax credits, solar renewable energy credits (SRECs) rebates or local feed-in tariffs, which, when stacked with federal incentives have pushed those states to the top of the list of installed solar capacity.”

Going Forward: Developing Markets, Developing Policies

In much of the developed world, feed-in tariffs have run their course. Now, developed nations–particularly those in the European Union who have pushed FITs the hardest–find themselves caught between their commitments to Paris Climate Accord carbon reduction targets and the need to properly distribute the power from their over-built renewable portfolios. Transmission solutions, like a continental energy grid, will be needed to move to the next level, as will market-based solutions that will ensure that new generation is built to match loads as well as meet targets. Massive solar development in Morocco and Algeria are just a trans-Mediterranean transmission cable away from delivering their energy to Spain and the rest of Europe.

Meanwhile, countries in Central America are quietly making serious moves into the solar market. Last year, it was not Germany or China who generated the highest percentage of annual solar energy, but rather Honduras. This poor country gets more than 10% of its electricity from solar each year and is pushing to increase its solar capacity. Nicaragua, El Salvador and Panama are all moving heavily to renewable energy production.

According to PV Magazine, FITs were established in Honduras in 2013, but have proven problematic and only moderately successful. Instead, market-based solutions have proven to be the most successful mechanisms for rapid deployment of solar in the Central American region. Auctions, sales of renewable energy on the spot market and bilateral contracts have been extremely successful. A combination of these policies has lead to the installation of over 600 MW of solar farms in recent years and In 2021, the region is expected to have more than 40 gigawatts of installed solar capacity, according to the latest edition of GTM Research’s Latin America PV Playbook. Several countries have also established net metering policies to support distributed generation and indie solar projects.

It’s not hard to understand why Central American renewables are taking off so fast. With little or no coal resources, expensive diesel generation or geothermal has been used as baseload generation. The recent drop in PV prices, along with the most consistent solar assets in the world makes PV a no-brainer.

Market Forces will Determine Long-Term Success

Obviously, it is essential to the health of the planet that new, clean energy technology is deployed as rapidly as possible. However, government incentives for renewables can only take us so far. A combination of approaches that fine-tune the generation and transmission mix will be needed to create a stable and secure global energy market that can both meet demand and reduce emissions. Although a successful carbon market has yet to emerge, some mechanism must be found to prevent the fossil fuel industry from continuing to externalize costs by dumping their waste product into the air. Outdated monopoly utility structures need to be opened up to innovation. A global energy grid needs to be established. In the meantime, look to our neighbors to the south for new and imaginative ways to build the clean energy economy.

Outdated monopoly utility structures need to be opened up to innovation. A global energy grid needs to be established. These types of major changes can only happen through well-crafted government policies like FITs. Once solar is allowed to compete, new market mechanisms can take over. In the meantime, we may want to look to our neighbors to the south for new and imaginative ways to build the clean energy economy.