Manufacturers of solar panels, inverters, and related solar energy components have overwhelmingly been based in China over recent decades as few countries around the World could compete with China’s combined natural resource and low-cost manufacturing advantages. While China’s supply chain stranglehold is likely to persistent for some time, recently announced investments by solar manufacturers in the U.S. show the benefits accruing from last year’s passage of the Inflation Reduction Act (IRA).

China’s Market Dominance

It’s hard to overstate how much of a stranglehold China has over the global solar energy supply chain. A recent deep-dive report compiled by the International Energy Agency (IEA) puts this fact into stark terms. According to the report:

“China’s share in all the manufacturing stages of solar panels (such as polysilicon, ingots, wafers, cells and modules) exceeds 80%. This is more than double China’s share of global PV demand. In addition, the country is home to the world’s 10 top suppliers of solar PV manufacturing equipment.”

China’s commanding influence is seen across all major solar panel inputs. In 2021, China could lay claim to 79% of global polysilicon capacity, 97% of wafer manufacturing, and was responsible for producing 85% of the world’s solar cells. Incredibly, the report even notes that 1-in-7 solar panels produced in the world comes from one single facility in China’s Xinjiang province.

The issues this poses to the global solar PV supply chain are obvious. When so much of an industry’s supply chain is focused on a small portion of the globe, production and shipping bottlenecks are inevitable and their global impacts could be paralyzing. Region-specific extreme weather events, shipping issues, political unrest, and labor shortages are just a sampling of the issues that could go wrong and bring the global PV supply chain to its knees. Not to mention potential Black Swan-like events like economic fallout from China’s simmering tensions with Taiwan.

The geographic concentration of mission critical solar PV components has led to massive supply-demand imbalances, which ultimately, has driven costs up. The IEA report notes, for example, that the price of solar panels spiked by 20% over the last year, largely spurred by an eye-popping quadrupling in the price of polysilicon.

The solar manufacturing cost advantages that China has cemented in recent decades are a direct result of policies championed by the Chinese government highlighting the solar PV industry as a national economic priority. Government policies encouraged economies of scale and innovations that helped to drive down production costs for solar. As a result, solar manufacturing costs in China are 20% lower than the United States.

IRA Seeks to Turn the Tide

The IEA report put in stark terms the competitive imbalance between the U.S. and China when it comes to solar manufacturing, and called on policymakers to establish financial and tax incentives that can help to reverse the tide.

The passage of the much-heralded IRA last year included such financial incentives to induce more domestic fabrication like an increase in the Investment Tax Credit (ITC) from 30-40% for projects using domestic products, as well as a product-specific production tax credit (PTC). The most impactful benefit, however, is the timeframe which extends the bill’s various incentives for 10 years, giving much-needed long-term certainty to manufacturers.

In addition to the IRA, the Biden Administration has been aggressive in pulling other levers of power to accelerate solar manufacturing growth opportunities in the United States. Last June, President Biden invoked the Defense Production Act (DPA) to boost domestic manufacturing of clean energy sectors – like solar panel manufacturing – while also instructing the federal government to increase purchasing commitments of U.S.-made solar panels and related clean energy products.

The President also announced around the same time period a 2-year moratorium from tariffs on solar panel imports from Cambodia, Malaysia, Thailand, and Vietnam. The goal of the move was to protect vulnerable solar jobs in the U.S. amid significant supply chain disruptions brought on by the Department of Commerce’s ongoing investigation into whether panels imported from these four Southeast Asian counties evaded tariffs placed on Chinese-made solar products.

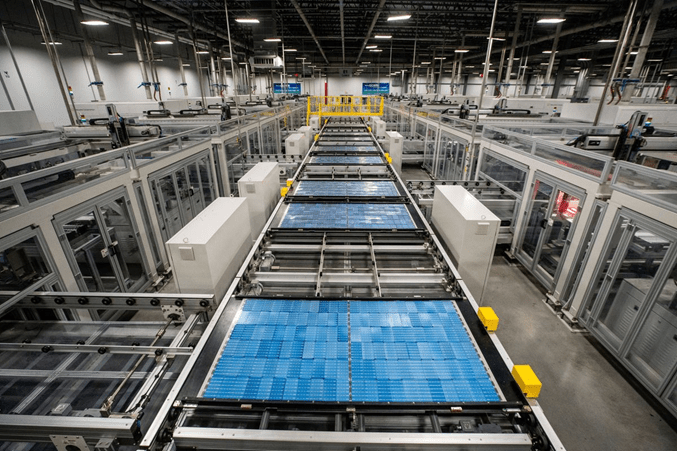

Solar Manufacturing Announcements Start to Pile Up

One of the primary goals of the IRA was to launch U.S. solar manufacturing capacity to new heights, and it sure is hard to argue with the results. The clean energy-focused non-profit advocacy group, Climate Power, released a report recently documenting new clean energy investments occurring in the U.S. between the signing of the IRA in August through the month of January.

The research by Climate Power shows that companies have announced more than 100,000 clean energy jobs in the United States since the passage of the IRA. These jobs are tied to 90 different clean energy economic development announcements across 31 different states, and they collectively represent nearly $90B in new capital investment. These figures are simply staggering by any measure and they once again underscore that climate action and our country’s economic future are inextricably tied to each other.

Advancing the nation’s solar energy capacity goals is imperative for addressing the global climate crisis, and the economic benefits that Americans stand to see are more evident now than ever. The national security imperative for domestic clean energy production investments are also increasingly clear. Just days ago, China was chided by the U.S. for having a surveillance balloon floating over the country’s heartland. With tensions between the two countries on the rise, the case for growing solar production capacity at home and weaning off the Chinese-based supply chain speaks for itself. The IRA has certainly primed the pump for doing just that, and we are excited to see the numerous domestic investments in solar production facilities announced in recent months. Hopefully this trend marks a turning point for the U.S. solar industry.