Over the last 10 years, the Solar Investment Tax Credit (ITC), which offers a federal income tax credit worth 30% of a homeowner’s solar installation costs, has opened up solar to millions of homeowners by dropping that huge financial hurdle.

But the ITC is set to begin phasing out at the end of 2019 and a group in Congress has introduced legislation to extend it for an additional five years. Obviously the solar industry would benefit from an extension, but has the tax credit succeeded in its mission already? And does an industry that’s so healthy still need this crutch today?

Lawmakers hope to extend solar ITC for five more years

On July 25, Nevada Senator Catherine Cortez Masto introduced legislation to extend the clean energy tax credits originally set to begin phasing out at the end of this year. The bill, named the Renewable Energy Extension Act, would extend the full 30% tax credit for solar installations an additional five years.

At the time, Masto said:

“Protecting the environment is good for our health and our economy. These tax incentives help us achieve these goals by increasing commercial and residential solar use, reducing carbon emissions, and creating good-paying jobs.”

This isn’t the first time Congress has considered extending this credit. The ITC actually has a long history of extensions. Back in 2005, the original 30% credit won bi-partisan support during the Bush administration, but was originally set to drop to 10% just two years later in 2007. Congress extended the credit until 2008, at which point Congress again passed an extension as part of Obama’s 2009 stimulus package, this time all the way out to 2016.

On the final day of 2015, Congress again agreed to extend the credit until 2019, with a gradual phase out over several years. Without an extension, the credit will drop to 26% until the end of 2020, then 22% in 2021, before dropping to 0% for homeowners and 10% for commercial projects permanently.

Solar tax credit designed to combat climate change

On pondering whether we should allow the ITC to expire, we should first find out exactly what the tax credit was designed to do. Was it to jump start a new tech industry? Help homeowners save some cash? When the ITC was extended in 2015, the 2016 US federal budget explicitly set out the purpose of the ITC and other clean energy programs:

“Cutting carbon pollution is essential to reducing the threat of climate change and represents one of the greatest economic opportunities of the 21st Century…To support the development of pollution-cutting technologies, the Budget invests approximately $7.4 billion in clean energy technology programs… that stimulate the evolution and use of clean energy sources such as solar, wind, and low-carbon fossil fuels, as well as energy-efficient technologies, products, and process improvements.”

The ITC then is designed to help cut carbon pollution and, by extension, fight climate change. As the only piece of federal legislation designed to stimulate a clean energy economy, the congresspeople supporting the extension say that the credit is necessary to continue moving the country towards a cleaner economy. The group’s letter states:

“The decrease of both credits should be delayed by at least as much time as it will take to implement a technology-neutral incentive or other federal legislation to reduce carbon emissions from electricity generation.”

With the absence of any wide-reaching federal climate policy, local governments are already moving forward on emissions-reduction tactics. A handful of cities and states like California, New York, and Washington have pledged to go 100% renewable or clean energy.

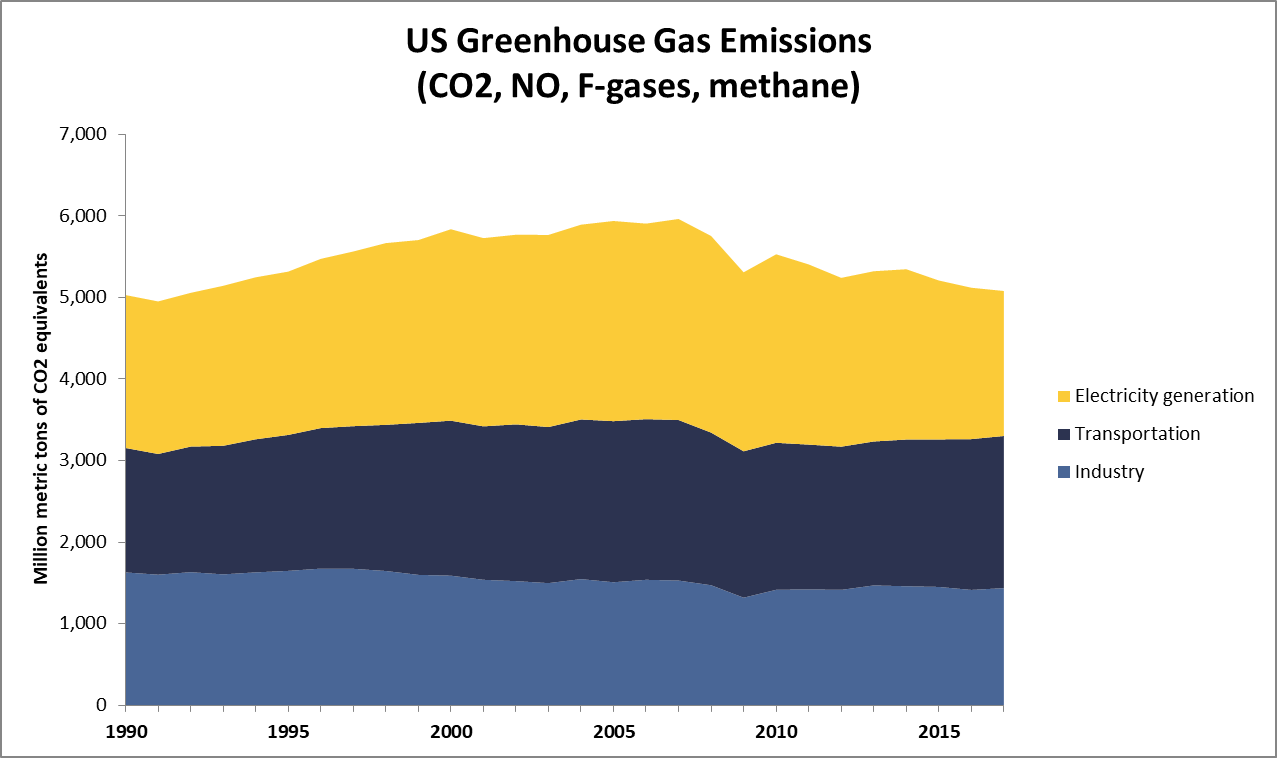

However, energy industry analysts often see both of these measures – clean energy goals and renewable tax credits – as stop-gap measures for real climate change legislation, like a national carbon tax, that would deal with emissions from all relevant sectors: electricity, industry, and transportation. As you can see in the graph below, while the electricity industry has been lowering emissions since the mid-2000s thanks to an increase in natural gas and renewables, transportation emissions is still increasing and per-capita emissions remain far above other developed countries like Germany, the UK, and Canada.

Considering the initial goal and the fact that the federal government seems far from adopting a true climate policy, extending the ITC another five years seems reasonable. It’s a square nail filling the round hole of carbon emissions, but it’s the only nail the federal government will likely pick up in the next four years.

Can the solar industry stand on its own two feet?

Few in the solar industry see an extension as a real possibility. Installers like Sunrun and Sunpower are hoping for an extension, but still prepping for the ITC to phase out this year.

While the industry is certainly in favor of an extension, the outcry doesn’t seem quite as loud as 2015. Over the last decade, the ITC has been a strong catalyst of growth for the U.S. solar market. Industry trade group SEIA claims that the solar industry has enjoyed a 50% annual growth rate since 2008 and that the tax credit is responsible for $140 billion in economic investment and creating ‘hundreds of thousands’ of jobs.

Solar installation costs have dropped about 60% since 2010 – from $7.30/watt to just $3/watt today. Installation costs have fallen to the point where even without the tax credit, homeowners in many states will still find roof-top solar a sound financial investment.

In the chart below, we compare $-per-kilowatt-hour costs of the average utility, roof-top solar with the 30% ITC, and roof-top solar without the 30% ITC (using solar energy production estimates from Denver, CO). Note that while an ITC-free installation doesn’t pencil out as well financially, from Year 1 it’s still lower than utility costs, which increase an average of 2.6% annually nationwide.

In the utility and commercial solar industry, installers are already planning to ‘safe harbor’ projects, a program in which the IRS grants extensions up to four years for projects that were begun in 2019. So if the tax credit isn’t extended, we can expect a surge of installations as 2019 progresses, as the industry rushes to begin projects before the credit starts to phase out.

As a policy to spur a clean energy industry towards growth and maturity, the ITC has certainly done its job. Over the last decade, the industry has seen truly jaw-dropping growth. Case in point: According to the EIA, solar generation jumped from a measly 157 gigawatt-hours in 2009 to 96,147 GWh in 2018. However, as a policy to combat climate change, the Solar ITC still has quite a bit it could get done.

Image Source: Public Domain via Pixabay