Elon Musk has people freaking out…again. This summer, he is rolling out “bold visions” quicker than a political speech writer.Fans love to hear his very believable plans for colonizing the planet Mars, but meanwhile here on earth, investors are apparently less excited to follow Musk’s relentless technological push forward into the future. Is Musk finally facing his Waterloo, or will he continue to beat the odds?

It comes as no surprise to some that Musk wants to close the solar/electric vehicle loop by cutting a deal in which his Tesla Motors would be buying one of his other companies, SolarCity, for between $2.59 billion and $2.78 billion worth of its stock. But Musk is the man that some investors love to hate, and Tesla stock dropped by almost 13% following the announcement. CNBC announced that “Tesla shares crater as Wall Street reacts to bid for SolarCity.” RBC Capital Markets analyst Joseph Spak told CNBC that while Tesla sees a number of synergies from the transaction, it will not be well received by shareholders. “We suspect the market will be more skeptical of the strategic rational (sic) and the financial/cash flow strain this could add to the TSLA story. By owning the asset, we believe TSLA may be trying the investing partner approach they have taken with shareholders and asking them to stick with them for something they potentially didn’t sign-up for,” Spak said.

Meanwhile, electrek.co points out that “Tesla’s SolarCity offer is primarily getting hate from people who don’t own the stock – and not only from people who don’t own the stock, but from people who are shorting the stock. People who benefit from the share price falling and people who will not vote on the planned merger.

Famed short seller Jim Chanos went on CNBC to call the deal a “brazen Tesla bailout of SolarCity”. Chanos has been shorting both stocks and he will not get to vote on deal. While he is entitled to his opinion and can try to influence shareholders, it will not have much impact at the end.”

RBC’s Spak may in one sense be right… investing in Tesla or one of Musk’s other ventures requires an act of faith greater than that required by investments in more conventional auto manufacturers or utility companies. Musk is asking investors to partner in a vision of future tech that makes Steve Jobs look like a slouch. That can be impossible pill for some to swallow, particularly those in the financial sector who don’t care to see a nerd beating them at their own game. But for others, it’s all about disrupting the status quo, and so far, Musk is disruptor in chief.

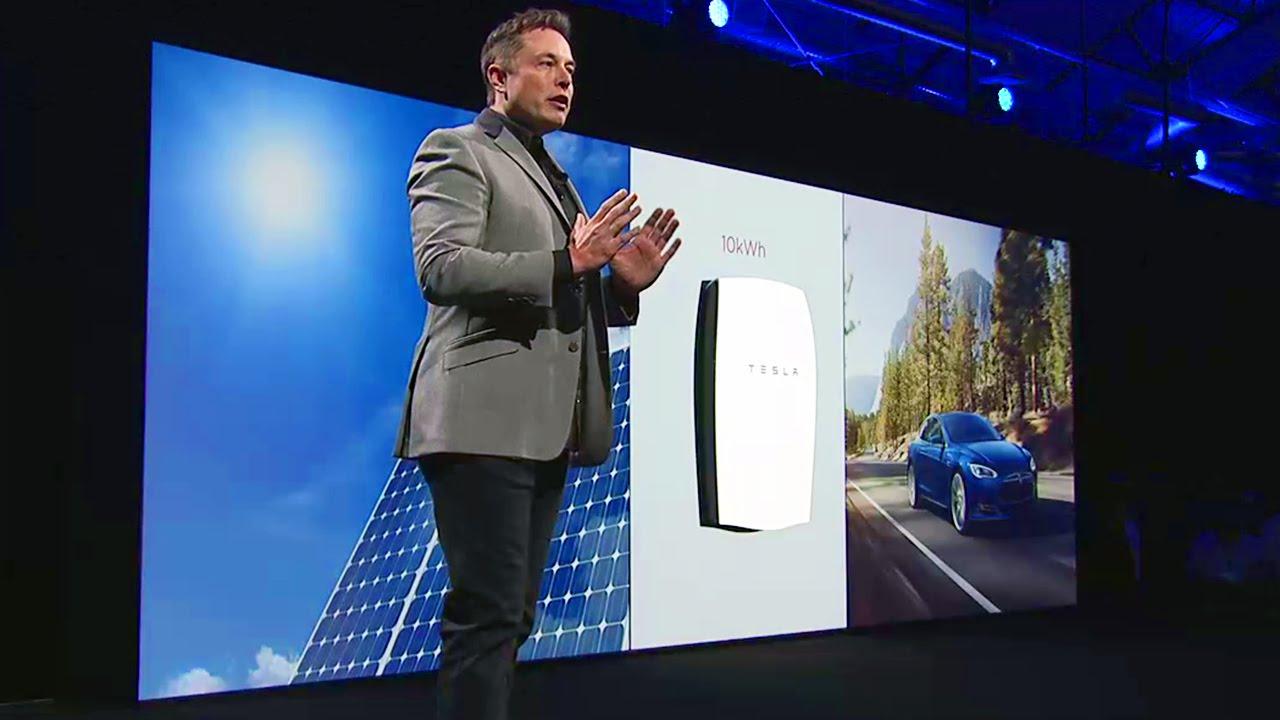

From the Tesla announcement: “It’s now time to complete the picture. Tesla customers can drive clean cars and they can use our battery packs to help consume energy more efficiently, but they still need access to the most sustainable energy source that’s available: the sun… We would be the world’s only vertically integrated energy company offering end-to-end clean energy products to our customers. This would start with the car that you drive and the energy that you use to charge it, and would extend to how everything else in your home or business is powered. With your Model S, Model X, or Model 3, your solar panel system, and your Powerwall all in place, you would be able to deploy and consume energy in the most efficient and sustainable way possible, lowering your costs and minimizing your dependence on fossil fuels and the grid.”

That is a vision so sexy, so intoxicating and so RIGHT that for some, gripes from Wall Street stuffed-shirts like Jim Chanos fall on deaf ears. This is about THE FUTURE, not about squeezing out a few bucks by the cynicism of short-selling. Some of Tesla’s biggest investors are ignoring players like Chanos. “It’s a natural evolution of their (Tesla’s) mission to transform transportation into a sustainable business,”Joe Dennison told Reuters. Dennison is a portfolio manager of Zevenbergen Capital Investments, which has about 600,000 Tesla shares, or about 0.4 percent of shares outstanding. It is still early in the process, he said, but “We expect it to go through and believe that most investors who actually own the stock understand management’s long-term vision for the company.”

The bottom line on the merger is, that it is a referendum on Musk himself. If investors say no, and a lot of investors are saying no, there will be no merger. That could be just the thing Musk needs to reign in his blue-sky approach and focus on delivering product. Or, it could be the first card to fall in the collapse of a house of cards.

Regardless of the outcome, expect Musk to do the unexpected. Fans and critics alike are holding their breath, awaiting his next move.