With solar installations roaring ahead at a record pace, why are solar stock prices slumping?

The World Wide Web is a wonderful thing… bringing us unlimited amounts of data at the touch of a button. However, sometimes it can bring us too much of a good thing. In the case of investing, there has never been so much analysis available, and yet in the end, most of it is merely speculation. It is my observation that in the case of the solar industry, we are seeing a the speculation becoming personal. Confirmation bias runs rampant both among solar cheerleaders and solar naysayers. Full disclosure: I’m a cheerleader. But you probably already guessed that.

As a cheerleader (and a solar installer) I like the numbers I see when it comes to growth in solar installations. The business is booming, and despite predictions of a solar bust from the naysayers, the industry has never looked healthier from the standpoints of technology, performance and production.

The latest report from The Solar Energy Industry Association and GTM Research shows continued impressive growth numbers. According to the report:

- Solar prices fell across all market segments, with declines ranging from 2-7 percent (see Figure 2.3)

- As a whole, the price of solar is 18 percent lower than it was one year ago, and 63 percent lower than it was 5 years ago.

- Solar represented 26 percent of all new electric generating capacity brought online in the first half of 2016.

- There are now 1,162,000 individual solar systems installed in the U.S., including more than a million residential systems.

- The utility-scale sector installed over 1 GW for the 3rd consecutive quarter, and will install nearly 10 GW by the end of this year.

- Thanks to strong growth by non-traditional markets like Texas and Utah, the residential sector experienced another record quarter, installing 650 MW.

A new solar installation was completed every 82 seconds in the first half of 2016, equaling over 1,000 installs every day. This frequency is what will take the current total of 1.1 million solar systems, which took 40 years to reach, to 2 million systems by 2018.

Did anyone read that story in the Wall Street Journal? I didn’t. But, I did read an article called “4 Reasons to Hate Solar Stocks” over on the Motley Fool investors site. I can’t say I disagree with the author’s conclusion. One of the biggest reasons for falling stock prices is exactly the same reason business is booming, and it is reason #1 in Travis Hoium’s article. “#1 – Falling costs have strange consequences. One of the biggest reasons solar energy has become so competitive and has so much potential is that the costs per kilowatt generated are falling. But falling costs can mean falling revenue and margins for solar companies.

When you look at the challenges most solar manufacturers have faced over the past five years, a lot of them stem from companies taking on debt and making large investments in manufacturing equipment, then watching the hardware coming off those production lines become less and less valuable each year.”

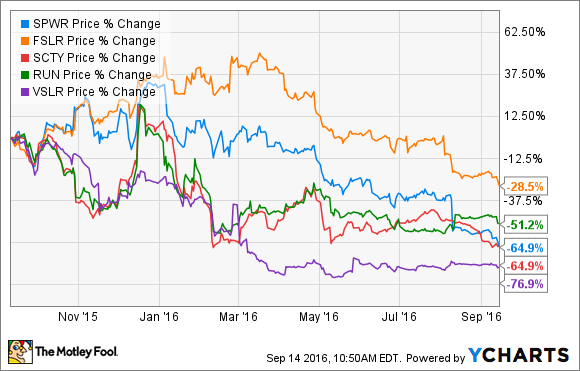

Solar industry leaders like SolarCity are struggling with the new growth, while others, like First Solar and SunPower are in virtual freefall, both hitting 52 week low per share stock prices. SunPower is currently at under $8/share, down from over $30 just a few months ago. This is NOT what we cheerleaders like to see.

Other factors are adding to uncertainty about solar stocks. Friends of fossil fuels within federal and state governments are working to de-stabilize hard-earned policies that have been put in place to level the playing field for renewables in the market of regulated monopoly utility companies. Sen. Orrin Hatch (R., Utah), the chairman of the Senate Finance Committee, and Rep. Kevin Brady (R., Texas), the head of the Ways and Means have formed a panel to go on a fishing expedition into subsidies received by SolarCity and others. With naysayers in congress as well as state utility boards, investing in solar will continue to be like betting against the bank.

Finally, there is the Federal Investment Tax credit to consider. The ITC is slated to drop from 30% to 10% for utility projects and third party-owned rooftop systems in 2017. This is causing a rush to install projects in 2016. What will really happen with the ITC? It all depends on what congress looks like after the election.

Are we looking at a solar crash in 2017? I don’t think so. At least I hope not…. After all, it’s all just speculation.

Wait… what about storage? Might energy storage save us? After all, I’m still counting on storage to be the big story of 2017! But then…I’m a cheerleader, right?