In August of this year, Wall Street Daily predicted that solar photovoltaic (PV) manufacturing would be “The Unlikely Driving Force Behind an Imminent Surge in Silver Prices.” In fact, all over the web, precious metals watchers are predicting a jump in silver prices due to increasing demand for the highly conductive metal by the booming PV market. According to an October 21, 2014 article at Forbes.com, “Assuming a balanced market in which supply matches demand, the demand for silver from the solar PV industry will rise from 10% of the total demand for silver in 2014 to around 15% in 2018.” However, since 2011, PV sales have risen to new heights, while silver prices have dipped to a five year low. What gives?

Currently, PV manufacturers use between 15 and 20 grams of silver in a new solar panel (by comparison, a new laptop contains approximately .75 grams of silver.) The Forbes article bases it’s projections on the assumption that 2.8 million ounces of silver are required to generate 1 GW of solar power, and that The incremental PV capacity addition in 2018 is expected to be between 39 and 69 GW. Are these assumptions realistic? And if so, will they actually translate into higher silver prices?

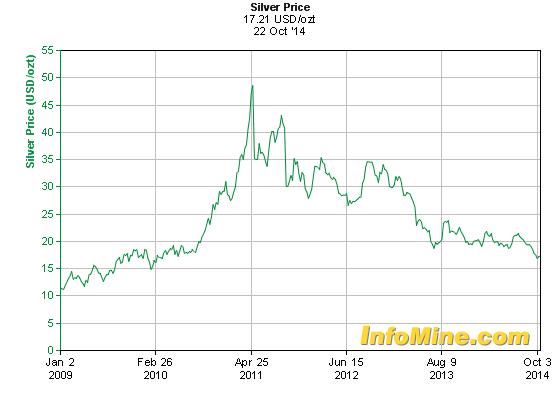

The reduction of silver use in PV panels is one of the holy grails of the solar industry. R&D teams have reduced usage of silver as much as two thirds in some new panels. Copper, nickel and tin are all showing promise as replacements for silver in PV panel busbars. A sudden turn in the global price of silver could be a major hit to PV manufacturers, or it may be the catalyst for a new wave of post-silver PV. In their 2012 report entitled ““Key Issues and Innovations in Photovoltaic Metallization,” Lux Research reports that the “Drive to reduce silver use is inevitable. Over the past decade, silver prices have risen six-fold to about $30/ounce, necessitating lower usage and other work-arounds. Applied Materials’ double-printing tool reduces silver usage by 30% relative to conventional screen printing and improves absolute cell efficiencies by 0.3% to 0.5%, offering the nearest term bang for the buck. But the technology roadmap won’t stop there.” Obviously, silver markets have been a roller coaster ride since the $30 an ounce numbers at the time of the Lux report to a current price of $17.44 (as of this writing, October 2014.) Now, PV manufacturers are happily chugging along, producing PV panels at under $1 per watt retail. Solar demand is growing rapidly, copper and tin based panel alternatives are back on the shelf and yet, silver prices remain in the basement, as compared to 2011, when silver was pushing $50 an ounce.

In addition to advances in technology that are lowering silver demands for solar panels, there are other factors that are affecting silver prices. These factors are far outside of the world of solar manufacturing. Precious metal prices have been highly volatile in recent years due to economic and regulatory factors having nothing to do with industrial demand. Fears about the market, currency fluctuations and an overall lackluster economy in the wake of the recession drove prices up, and, of course, what goes up must come down. Last year, demand for silver dropped and so did the price, but the low price has once again sparked demand, including the Indian jewelry silver market, which bought 17% of the silver in 2013. Despite the demand, silver prices remain low, leading speculators to scratch their heads. In many respects, the projections of PV manufacturing driving silver prices higher sounds a bit like wishful thinking.

At this point in time, the markets are a confusing place to be, and even the seasoned pros are struggling to make sense of the current directions in both the silver and the solar markets. With solar stocks being unjustly penalized by falling crude oil prices ( see “Solar Stocks Struggle to Decouple from Crude”) we are seeing powerhouse companies like industry giant SunPower down 23% and China’s upstart Trina Solar down 30%. Can silver fans really count on solar’s growth to spur a recovery in silver prices? At this point, it’s a stretch. And what about solar enthusiasts? It looks like a the grey clouds over silver and solar stocks may have a “silver lining” for them. For now, weak silver prices and lower solar stocks probably mean cheaper solar panels in the near term.