Tesla is dealing with the same headwinds that have roiled the broader solar industry, and they are sure to take some lumps in 2020. However, the company’s enviable diversification and revamped approach to selling solar panels has them well-positioned to not just adapt, but thrive as we all adjust to the “new normal.”

Panel Prices Slashed

Tesla got into the rooftop solar installation business in earnest back in 2016 through its acquisition of SolarCity, and today, Tesla ranks 3rd among national residential solar installers. However, the #1 ranked residential solar installer, Sunrun, recently announced plans to acquire the industry’s #2 ranked residential installer, Vivint. The move will effectively make the combined company and Tesla the top two residential solar installers in the country. The latest move in the solar arms race is likely to spur more competitive pricing for the average consumer as the two companies jockey for market share.

Even before the Sunrun-Vivint news broke, Tesla was making headway on reducing pricing for its solar panels. In a blog post from last month, Tesla announced their plans to cut the price of their solar panels so that they will be lower than the average industry price by about one-third. This comes on the heels of Tesla improving the efficiency of their solar panels by 10%, which is nothing to sneeze at.

Tesla’s reduced solar offerings are categorized by system size with the smallest 4.1 kW system running at just $7,400 after accounting for federal tax incentives.

Tesla credits its solar panel price cut to a revamped ordering approach that shifts the process entirely to an online shopping format. This significantly reduces sales and marketing costs for the company and greatly eases the buying process for the consumer – a win-win for everyone. Tesla explains on their blog post:

“Our new pricing is made possible by several simple improvements to a decades-old industry. We made ordering and installing solar easy by moving to fixed sizes that customers can order with a single click online — no more need to spend hours in consultations reviewing old utility bills. More than 80% of our customers move forward with the standard size recommended by our website, and the move to a digital experience helped cut our sales and marketing costs by 64%.”

Tesla also announced this month that their solar referral program will be getting more lucrative for the consumer. Improving the solar referral program seems to be something of a 2020 priority for Tesla. In January, the solar referral was improved to $250 for both the referrer and the new buyer, after previously being a $100 benefit. This month, Tesla announced that customers will receive $400 for each solar referral, and receive one Powerwall battery after successfully referring at least 10 new solar customers.

Solar Sales Slump Amid Pandemic

It is hard to know if Tesla’s recent push to revamp their solar pricing model and provide other inducements for customers is part of a long-planned strategy or an effort to get ahead of the pandemic-related downturn (I suspect the latter). Regardless, the company’s recent Q2 earnings report underscores just how tough 2020 is likely going to be for Tesla and other solar installers.

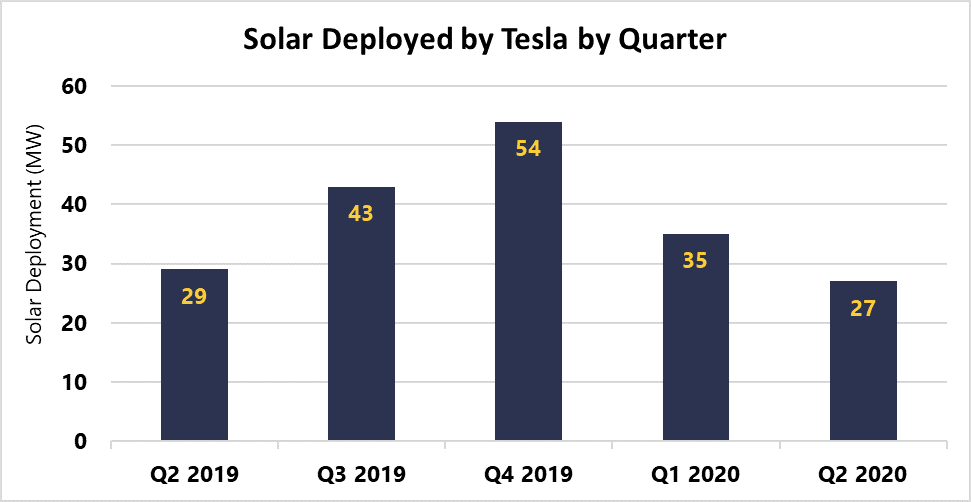

Tesla reported that rooftop solar installations declined by 7% year-over-year in Q2 2020. This is a somewhat significant drop in business given the fact that the Q2 2019 solar deployment figure of 29 MW was previously the company’s lowest quarter on record.

The dip in solar deployment is obviously due to restrictions brought on by pandemic-induced shutdown orders from earlier this year. A noteworthy silver lining to the dip in residential solar deployment for Tesla is the fact that installations of Tesla’s niche Solar Roof product tripled from Q1 to Q2 in 2020. This growth is both a byproduct of increased consumer demand – thanks to a more optimized and affordable product – and the company’s increased production capacity. The New York Gigafactory where Solar Roof product is produced hit the pivotal 1,000 unit per week production mark back in March.

Congratulations Giga NY team!

— Elon Musk (@elonmusk) March 15, 2020

In many respects, Tesla is probably the best positioned company in the solar industry to adapt to an environment where traditional in-person solar sales are going by the wayside. While most other solar installers are scrambling to embrace an online-focused sales model, Tesla has been operating that way for some time now. It is possible that Tesla’s Q2 2020 showing – while its worst ever – will pale in comparison to what other major solar installers report for the quarter. Earnings for Sunrun and Vivint – to be revealed in coming weeks – will surely be watched closely.

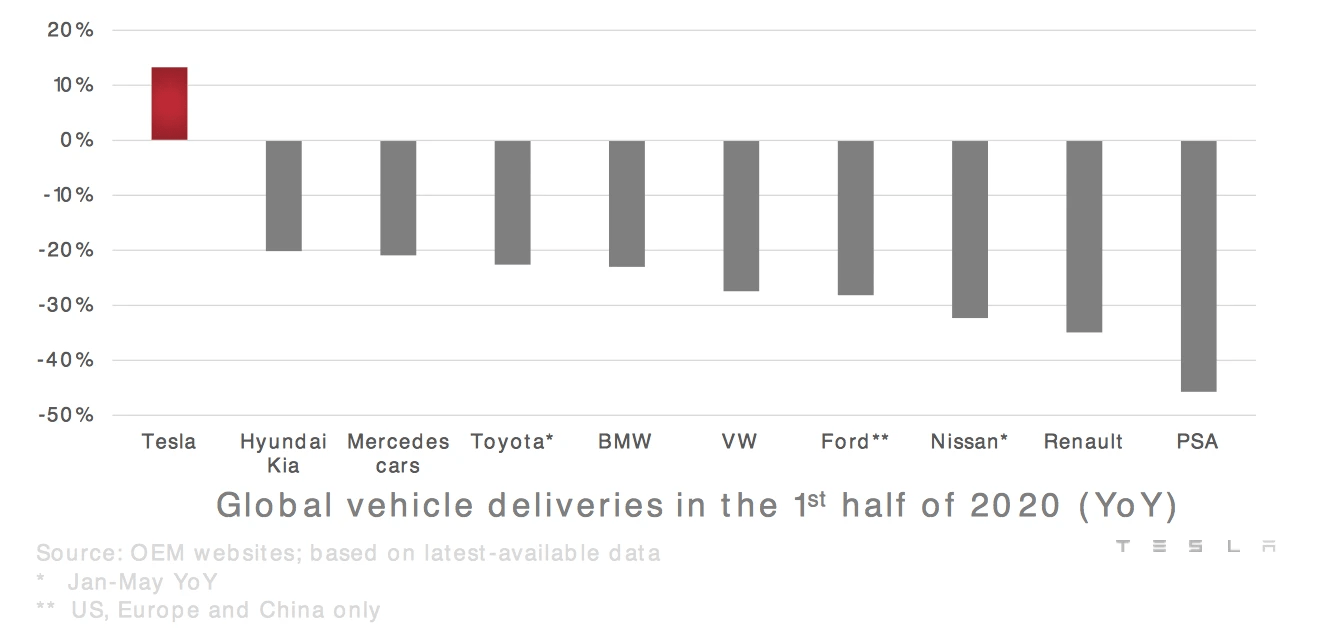

Vehicle Sales Weather the Storm

On the vehicle front, the storyline was quite different. Tesla reported on their Q2 earnings report that they were able to see positive year-over-year growth in vehicle deliveries (Jan-May), all while the industry as a whole was down 30%. Tesla was the outlier in the industry, as the world’s other major automotive companies saw steep declines in vehicle production since the beginning of the year.

Tesla’s ability to deliver over 90,000 vehicles in Q2 2020 is somewhat miraculous given that the company’s main facility in Fremont, CA was closed for nearly half of the quarter. The company is still committed to its pre-pandemic promise of delivering 500,000 electric vehicles to customers this year. To-date, they’ve delivered just under 180,000.

Company CEO, Elon Musk, is bullish on all things Tesla, so delivering 300,000 electric vehicles in just over 5 months is a tall order that he is happen to take on. In another sign of not letting current economic headwinds derail long-term goals, Musk and Tesla unveiled one of its most pivotal facility investments to-date when they recently announced plans to build a new Gigafactory near Austin, Texas. The new facility will span 4-5 million square feet and be tasked with producing the Cybertruck, as well as the Model 3 and Model Y for eastern U.S. deliveries.

The planned Austin facility joins a growing portfolio of auto parts facilities in the U.S., Europe, and China that are steadily enabling Tesla to achieve the economies of scale required for more efficient delivery of electric vehicles to all corners of the world.

Solar Storage Shows Promise

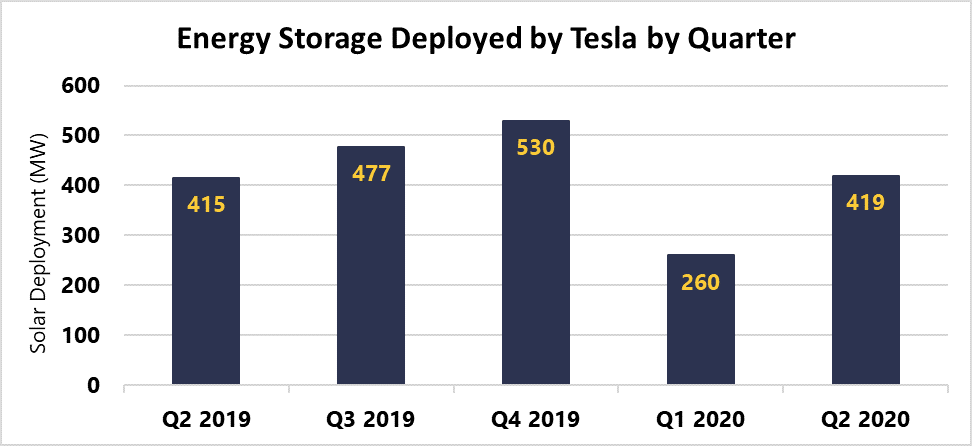

Musk’s dream for Tesla is and always has been to grow the company into a clean energy behemoth that is appropriately diversified across the electric vehicle, solar panel, and solar storage sectors. Even in the midst of an unprecedented global economic slowdown, the realization of that vision continues to show signs of progress. The positive momentum that Tesla is building with energy storage is perhaps the clearest indicator.

In their Q2 2020 earnings report, Tesla reported that total battery storage deployed in the quarter totaled 419 MWh, a 1% year-over-year increase and a significant 61.2% from the first quarter of the year.

Of particular note is the fact that Tesla’s largest energy storage solution, Megapack, turned a quarterly profit for the first time after just being launched to market last year. The Megapack is capable of storing up to 3 MWh of electricity and is designed to be used by utility companies to supply the grid during periods of peak demand.

Construction began just this month on a massive Tesla Megapack installation project in Monterey County, California for the state’s most prominent utility, Pacific Gas & Electric (PG&E). The Moss Landing project consists of a total of 256 Megapack battery units that will collectively comprise a 182.5 MW/730 MWh energy storage system. PG&E and Tesla also have a contract in place for a subsequent 300 MW system to be built at a later date at the same location.

Once the Moss Landing Megapack project is completed, Tesla will lay claim to having the two largest lithium-ion storage projects in the world using their batteries, with the highly-acclaimed Hornsdale Power Reserve in Southern Australia finished earlier this year being the other.

Tesla’s naysayers like to discredit the company by referring to the company as “just” an automotive company. Musk has made it clear, however, that he is not content on building a global electric vehicle giant that just dabbles in solar panels and batteries. He is thoroughly committed to all three pillars that will stand up a more sustainable future for the world – electric vehicles, solar panels, and solar storage. On the Q2 earnings call, Musk reiterated this commitment stating that Tesla Energy will one day be just as big as the Tesla Auto division. When you consider that the Tesla Energy division currently has about one-tenth the of the revenues of its sister division, you begin to see the immense growth potential in company valuation and in global influence as Tesla helps to fuel a more rapid adoption of sustainable energy practices.

In sum, Tesla’s performance as a company through one of the most tumultuous economic periods in modern history is just another reminder that those who bet against Tesla do so at their own peril.

Cover Photo Source: Fortune.com